If the business failed to file a required form or schedule, the IRS will notify you via U.S. If you overpaid tax, the IRS sends a check. If you owe more tax, the IRS sends a bill. Those errors are generally corrected by the Internal Revenue Service. Keep in mind that clerical mistakes and math errors do not require filing an amended return.

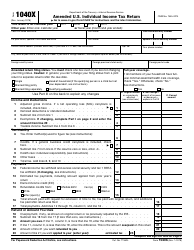

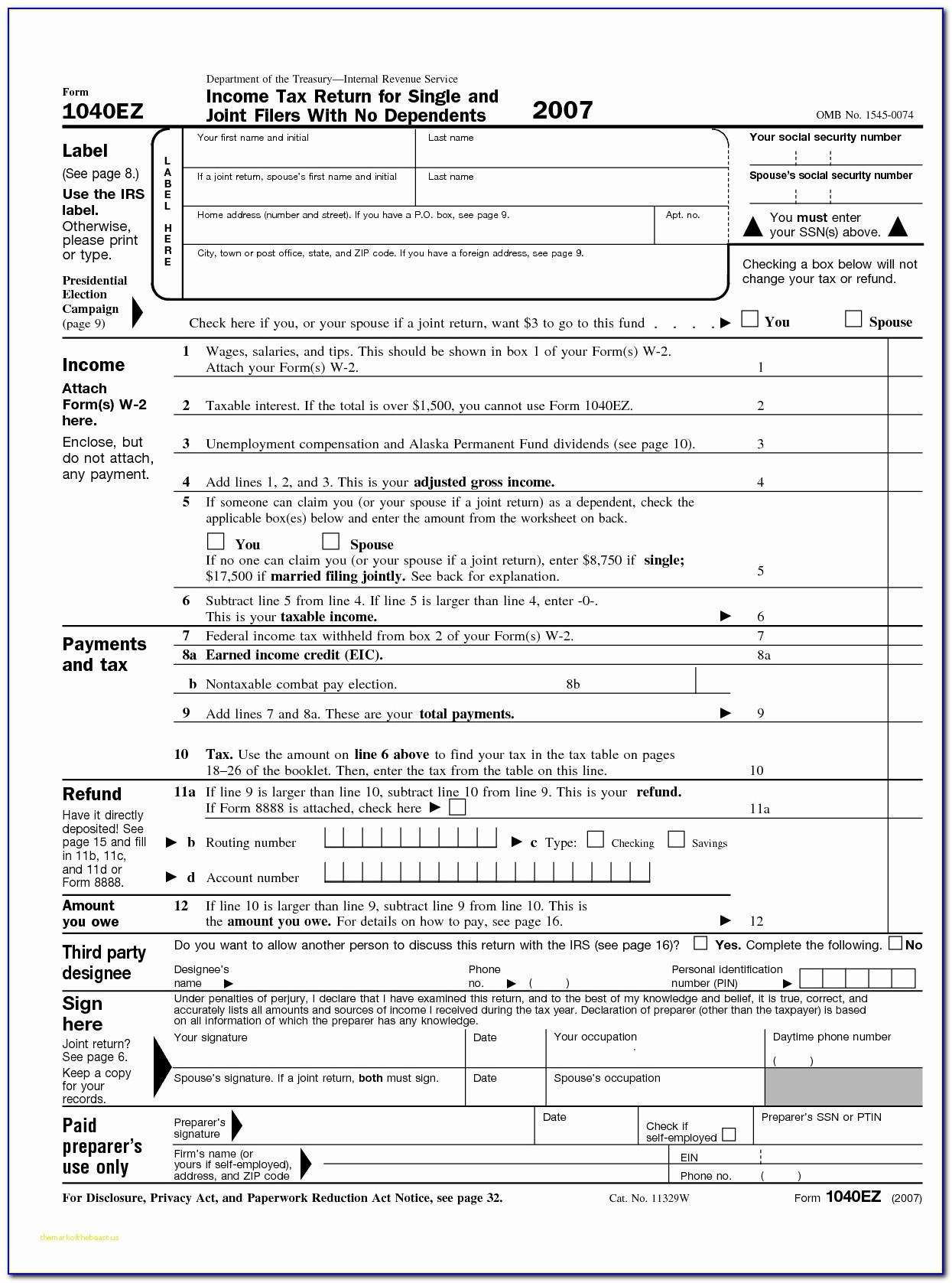

Perhaps an information statement was sent to you with corrections for the income or withholding amounts. For example, you may not have received a 1099 and didn’t include it in your filing. The realization that you were ineligible for a deduction, credit, or expense that was claimed.Īdditional information received that requires inclusion. Incorrect number of dependents or exemptions.įailure to claim tax deductions or credits. There are certain incorrectly reported items or omissions that necessitate filing an amended income tax return. When should you file an amended return? That’s Form 1040-X, the amended U.S.

0 kommentar(er)

0 kommentar(er)